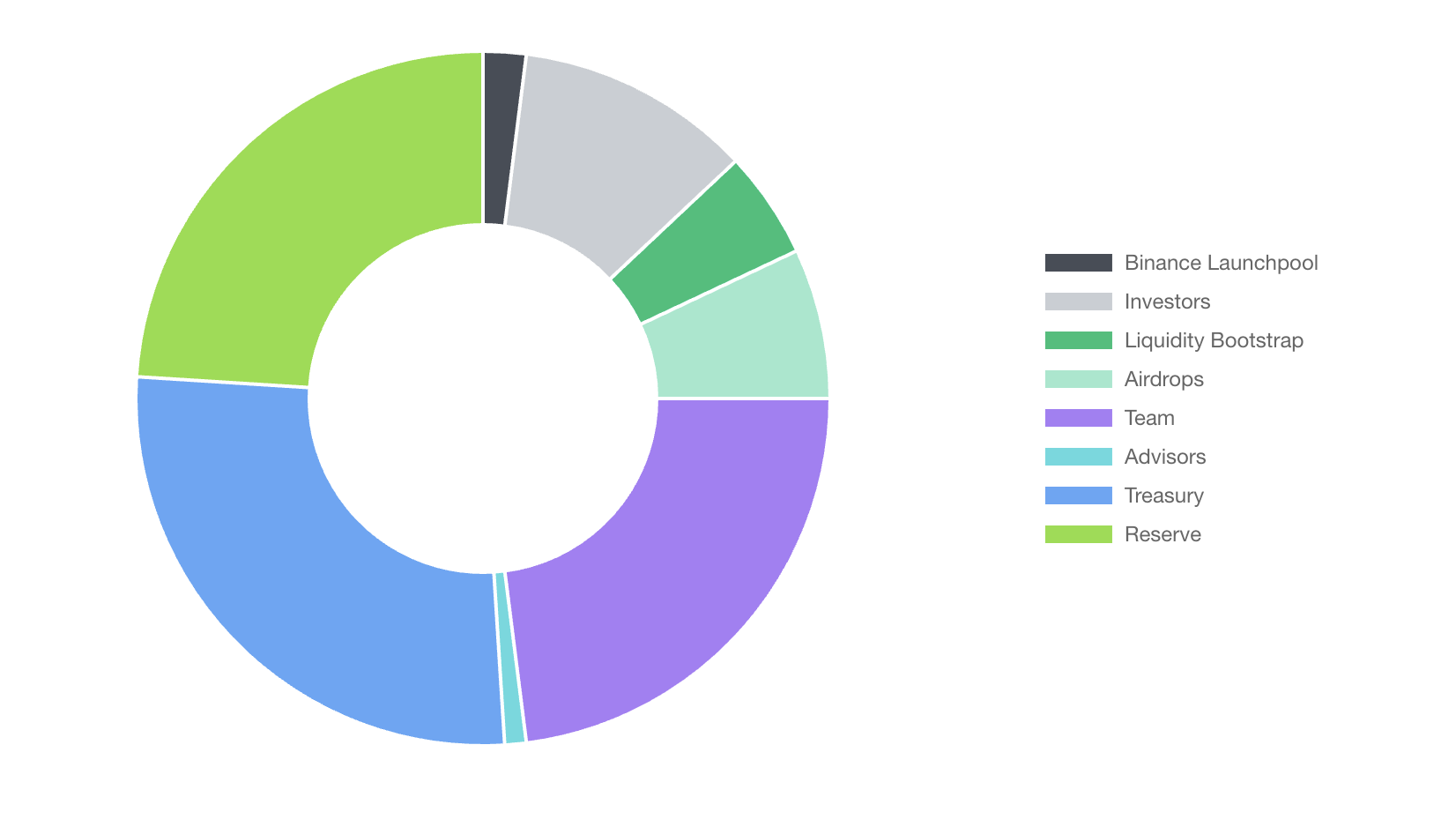

Token Distribution

NTRN tokens were initially distributed across various stakeholders:| Allocation | Percentage | Amount (NTRN) |

|---|---|---|

| Treasury | 27.00% | 270,000,000 |

| Reserve | 24.00% | 240,000,000 |

| Team | 23.00% | 230,000,000 |

| Investors | 11.00% | 110,000,000 |

| Airdrops | 7.00% | 70,000,000 |

| Liquidity Bootstrap | 5.00% | 50,000,000 |

| Binance Launchpool | 2.00% | 20,000,000 |

| Advisors | 1.00% | 10,000,000 |

Token Generation Event

The initial distribution of NTRN tokens was facilitated through a multi-component Token Generation Event (TGE) designed to distribute tokens fairly while building initial liquidity:Airdrop

7% of NTRN supply was airdropped to ATOM stakers and other qualifying Cosmos ecosystem participants to bootstrap the initial community.

Lockdrop

Users locked LP tokens from axlrUSDC/NTRN and ATOM/NTRN pools for various durations to receive NTRN tokens proportional to their contribution.

Liquidity Bootstrap Auction

5% of NTRN was allocated to bootstrap initial liquidity pools, with participants receiving both LP tokens and additional NTRN incentives.

- Credits Contract: Managed token vesting and distribution

- Airdrop Contract: Distributed tokens to eligible addresses using Merkle proofs

- Auction Contract: Facilitated NTRN-NATIVE pool initialization

- Lockdrop Contract: Enabled users to lock LP tokens to receive NTRN

- Vesting LP Contract: Managed the vesting of LP positions over a 90-day period

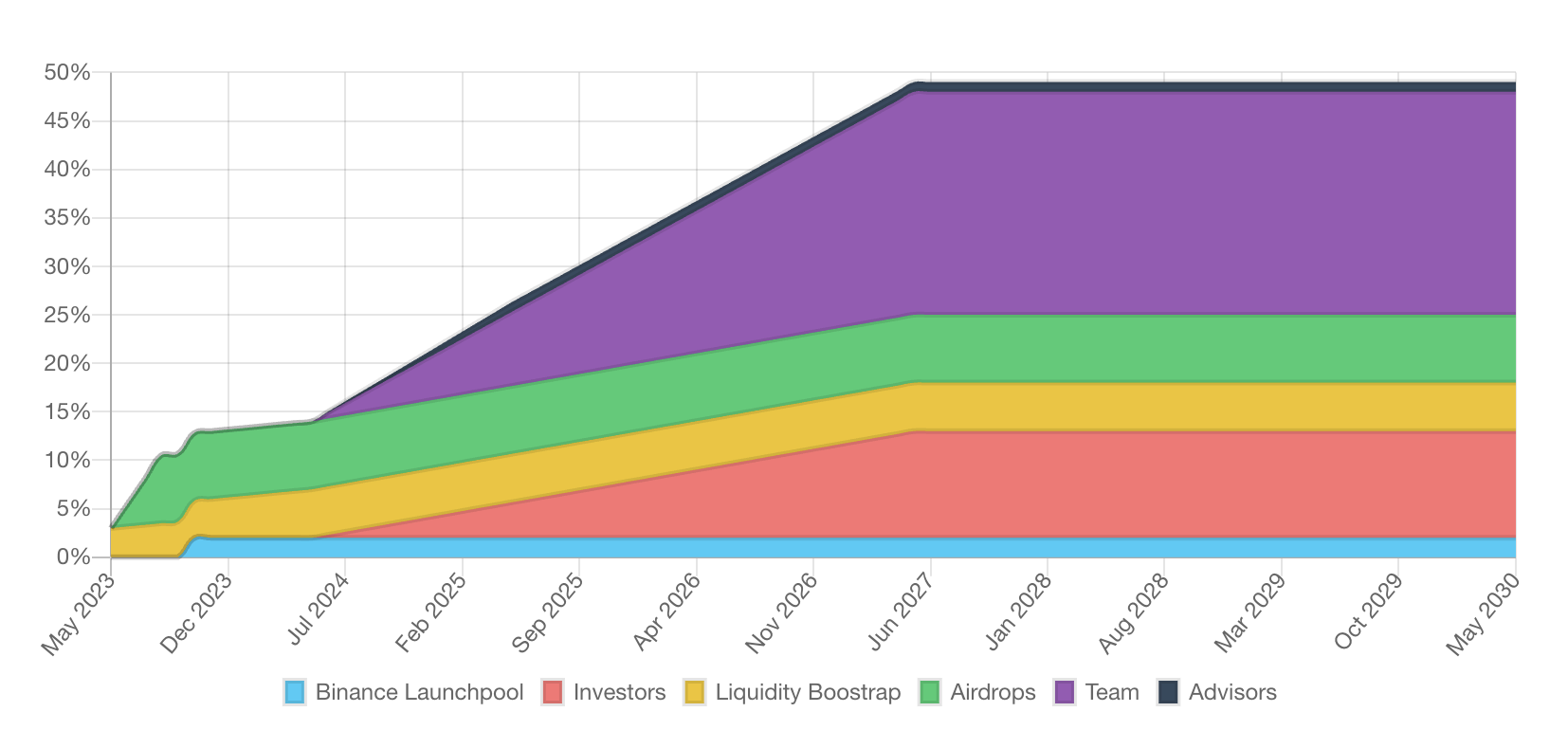

Token Unlock Schedule

NTRN follows a gradual unlock schedule to ensure long-term network stability and align incentives of different stakeholders.

Binance Launchpool

A portion of NTRN tokens (2.00% of the total supply) was distributed through Binance Launchpool:- Total Launchpool Rewards: 20,000,000 NTRN

- Duration: 20 days (started October 11, 2023)

- Staking Options: BNB, TUSD, and FDUSD pools

- Initial Circulating Supply: 217,112,292 NTRN (21.71% of total)

Fee Model and Distribution

Neutron features an innovative multi-denomination fee system:- Multi-Denom Fees: Transactions can pay gas in any liquid token on the network

- NTRN/ATOM Discount: 30% discount when using NTRN or ATOM for gas fees

- Gas Limit: 330M gas per block (11× increase post-Mercury)

- Fee Distribution: 100% of fees stay within Neutron’s economy

Pre-Mercury Fee Distribution

Before the Mercury upgrade, Neutron operated under the Interchain Security model (ICS) with the following fee distribution:- 25% of transaction fees were sent to the Cosmos Hub as payment for security services

- The remaining 75% were either burnt (if paid in NTRN) or sent to the Reserve (if paid in ATOM or other tokens)

Note: Following the Mercury upgrade, this fee-sharing arrangement with the Cosmos Hub was discontinued as Neutron became a sovereign chain with its own security model.

Treasury System

Neutron operates a sophisticated treasury system that manages the protocol’s funds and token distribution:DAO Treasury

The Neutron DAO Treasury is the primary fund manager post-Mercury, holding a significant portion of NTRN tokens to serve multiple purposes:- Fund validator operations (base compensation)

- Pay staking rewards to delegators

- Bootstrap liquidity across the DeFi ecosystem

- Support ecosystem growth through incentives and grants

- Fund ongoing development of the network

Reserve Contract

The Reserve contract, instantiated at genesis, was designed to hold vested NTRN tokens. Key features include:- Vesting Mechanism: Reserve tokens are vested based on on-chain activity—the more NTRN tokens burned through transaction fees, the more tokens get unlocked from the reserve

- Distribution Control: The contract is controlled by the Neutron DAO

- Vesting Formula: Uses a mathematical formula based on burned tokens to calculate release rates, ensuring a gradual distribution of tokens

Distribution Contract

The Distribution contract handles the second stage of token distribution:- Distributes tokens between a configurable set of “shareholders” (addresses with assigned weights)

- Allows shareholders to withdraw collected tokens based on their proportional shares

- Can only be configured by the Neutron DAO

Key Treasury Allocations

Following Mercury, the DAO deployed Treasury funds to establish a robust DeFi landscape:- Staking: ~225M NTRN staked with Drop Protocol for network security

- Liquidity: ~25M NTRN allocated to dNTRN-NTRN liquidity

- Lending Capacity: 5M NTRN allocated to lending protocols

- Staking Rewards: 6M NTRN pre-loaded for delegator rewards

- Validator Compensation: 700k NTRN allocated for validator payments

Staking Economics

Following the Mercury upgrade, Neutron transitioned to a sovereign security model with unique staking parameters:For Delegators

- Target Staking APR: 3% annually

- Source of Rewards: Neutron DAO Treasury (not block rewards)

- Slashing: Initially disabled (to be reassessed as the network matures)

- Unbonding Period: 20-day unbonding

- Delegation Method: Native staking or liquid staking via partners

For Validators

Validator compensation and performance requirements are detailed in the Proof of Liquid Staking section and Validators documentation.Token Utility

NTRN serves multiple functions within the ecosystem:- Security: Stake NTRN to secure the network

- Governance: Use NTRN in governance vaults to participate in decentralized decision-making

- Transaction Fees: Pay reduced gas fees when using NTRN

- DeFi: Use NTRN and its derivatives (like dNTRN) across Neutron’s integrated DeFi protocols

- Collateral: Use NTRN as collateral in lending markets

- Deflationary Mechanism: When paid as transaction fees in NTRN, a portion may be burned to create deflationary pressure

Governance Rights

Governance power in Neutron comes from NTRN in voting vaults:- Voting Mechanism: Deposit NTRN to dedicated voting vaults to gain governance power

- Staked Voting: Native stakers receive 1 point of governance power per NTRN delegated

- Proposal System: Standard Cosmos SDK governance with deposit, voting, and execution phases

- Voter Rewards: Potential incentives for governance participation

Liquid Staking

Neutron actively encourages the development of liquid staking derivatives:- dNTRN: The primary liquid staking token for NTRN, enabling users to maintain liquidity while staking

- Composability: Use dNTRN throughout the DeFi ecosystem while earning staking rewards

- Deep Liquidity: Protocol-owned liquidity ensures smooth trading between NTRN and dNTRN

Comparison to Traditional PoS Models

Neutron’s economic model differs from traditional proof-of-stake in several key ways:| Feature | Traditional PoS | Neutron’s Model |

|---|---|---|

| Supply | Inflationary | Fixed Supply |

| Block Rewards | From inflation | From Treasury |

| Validator Role | Governance representatives | Infrastructure providers |

| Slashing | Required for security | Replaced by jailing and performance incentives |

| Commissions | Set by validators | Not applicable (direct Treasury payments) |

| Fee Distribution | To validators/delegators | To Treasury and ecosystem |